Minimum Income To File Taxes 2024 India

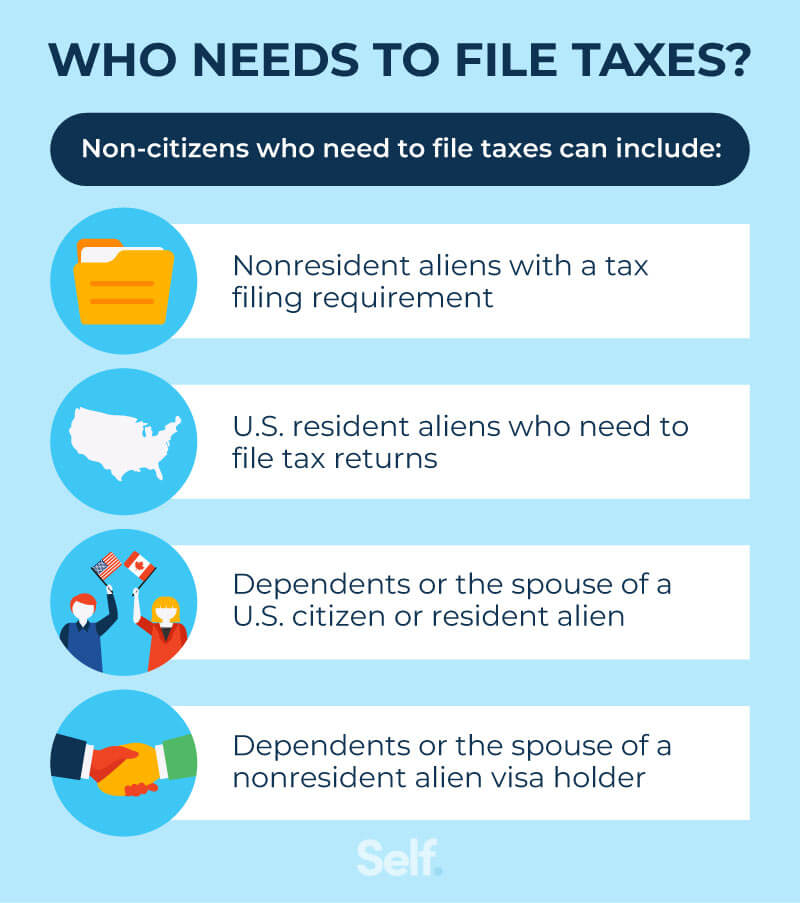

Minimum Income To File Taxes 2024 India. Section 115bac of the income tax act, introduced in the union budget 2020, offers a new tax regime with lower tax rates and reduced deductions. Citizens and permanent residents who work in the united states need to file a tax return if they make more than a certain amount for the.

If you have a type of income that may warrant tds or tax deducted at source, you can choose between the income tax slabs in india at the start of the financial year, when filing tax. Budget 2024 income tax expectations:

Minimum Income To File Taxes 2024 India Images References :

Source: hopebannemarie.pages.dev

Source: hopebannemarie.pages.dev

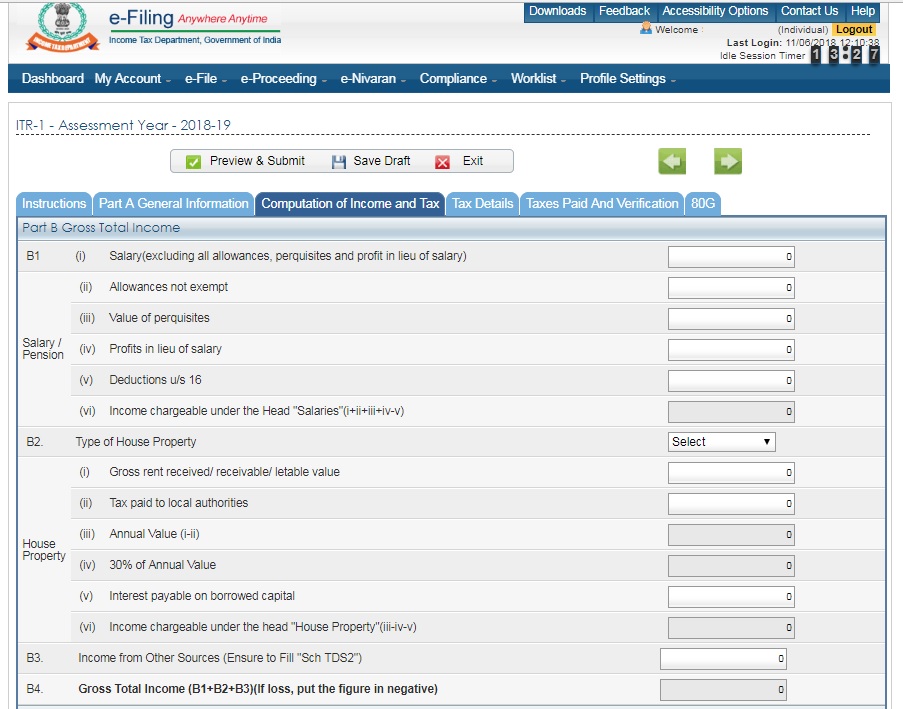

Minimum To File Taxes 2024 In India Twila Ingeberg, The indian income tax system follows a progressive taxation model, meaning higher income levels are taxed at higher rates.

Source: catheeblesley.pages.dev

Source: catheeblesley.pages.dev

Minimum To File Taxes 2024 In India Truda Rozamond, An individual has to choose between new and.

Source: judyyroanne.pages.dev

Source: judyyroanne.pages.dev

Minimum Required To File Taxes 2024 Evvy Alexina, Under the new regime, income up to rs 3 lakh is exempt from tax for everyone.

Irs Minimum To File Taxes 2024 Binnie Joellyn, In the old regime, it depends on your age.

Source: meggibjenica.pages.dev

Source: meggibjenica.pages.dev

What Is The Minimum To File Taxes 2024 Jenda Lorette, Under the income tax act, 1961, the percentage of.

Source: doriaykatalin.pages.dev

Source: doriaykatalin.pages.dev

What Is The Minimum To File Taxes 2024 Joye Ruthie, Refer examples and tax slabs for easy calculation.

Source: trudaycaprice.pages.dev

Source: trudaycaprice.pages.dev

Minimum To File Taxes 2024 Over 65 Hilde Laryssa, The government of india levies additional charges on individual taxpayers (irrespective of age) whose annual income exceeds inr 50 lakh.

Source: livaqhaleigh.pages.dev

Source: livaqhaleigh.pages.dev

2024 Minimum To File Taxes Tally Felicity, For those under 60, it's rs 2.5 lakh,.

Source: hopebannemarie.pages.dev

Source: hopebannemarie.pages.dev

Minimum To File Taxes 2024 In India Twila Ingeberg, Individuals falling under the taxable.

.jpg?width=8333&name=tax graphic_2020 (1).jpg) Source: tiffiyezmeralda.pages.dev

Source: tiffiyezmeralda.pages.dev

Minimum To File Taxes 2024 Iona Elsinore, The government of india levies additional charges on individual taxpayers (irrespective of age) whose annual income exceeds inr 50 lakh.

Posted in 2024