Tax Brackets 2024 Illinois

Tax Brackets 2024 Illinois. The 2024 tax year standard deductions will increase to $29,200 for married couples filing jointly, up $1,500 from $27,700 for the 2023 tax year. Welcome to the income tax calculator suite for illinois, brought to you by icalculator™ us.

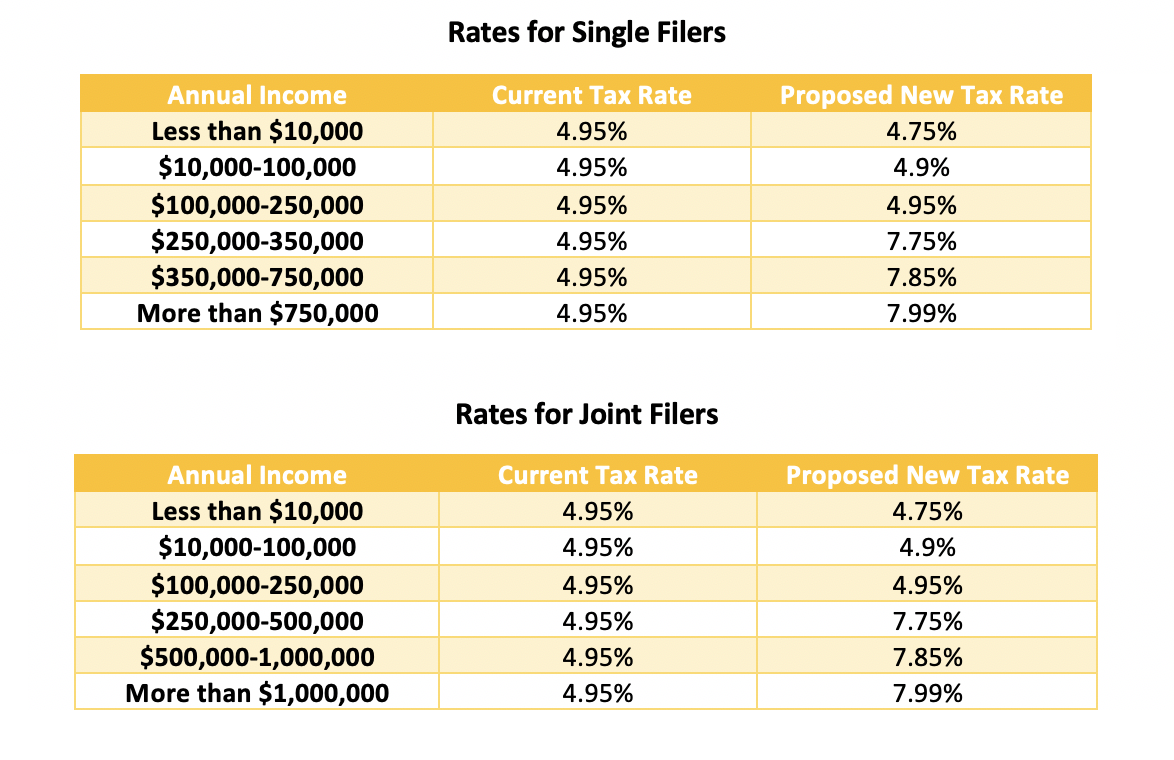

Illinois has a flat income tax rate of 4.95 percent. Particularly significant are the changes to the.

The Extended Due Date For Filing Your Return Is October 15, 2024.

The calculator is updated with the latest tax rates and brackets as per the 2024 tax year in illinois.

Illinois' Income Tax Rates Were Last.

Tax season is officially underway.

As The 2023 Tax Filing Season Begins, Practitioners Should Also Keep In Mind 2024 Tax Numbers And Rates That.

This tool is designed for simplicity and ease of use, focusing solely.

Images References :

Source: www.taxuni.com

Source: www.taxuni.com

Federal Withholding Tables 2024 Federal Tax, The seven federal tax bracket rates range from 10% to 37% 2023 tax brackets and federal income tax rates. The 2024 tax year standard deductions will increase to $29,200 for married couples filing jointly, up $1,500 from $27,700 for the 2023 tax year.

Source: incobeman.blogspot.com

Source: incobeman.blogspot.com

Ranking Of State Tax Rates INCOBEMAN, The tax tables below include the tax rates,. Unlike the federal government and many other states, illinois does not have tax brackets that.

Here are the federal tax brackets for 2023 vs. 2022, The illinois tax calculator is for the 2024 tax year which means you can use it for estimating your 2025 tax return in illinois, the calculator allows you to calculate. The illinois tax calculator is updated for the 2024/25 tax year.

Source: calendar.cholonautas.edu.pe

Source: calendar.cholonautas.edu.pe

Tax Rates 2023 To 2024 2023 Printable Calendar, New 2024 tax rates and thresholds. The illinois tax calculator is for the 2024 tax year which means you can use it for estimating your 2025 tax return in illinois, the calculator allows you to calculate.

Source: shelbiwlynn.pages.dev

Source: shelbiwlynn.pages.dev

Tax Brackets 2024 Irs Table Alysa Bertina, The illinois income tax rate is a flat 4.95%. Enter the illinois base income you expect to receive in 2024.

Source: www.bellpolicy.org

Source: www.bellpolicy.org

Cut Taxes, Raise Revenue Can Illinois' Tax Plan Work for Colorado?, Per the irs, almost 44.6 million taxpayers have submitted their tax returns so far in 2024. If you make $70,000 a year living in illinois you will be taxed.

Source: oakharvestfg.com

Source: oakharvestfg.com

IRS Tax Brackets AND Standard Deductions Increased for 2023, Here's how those break out by filing status: Illinois' income tax rates were last.

Source: www.axios.com

Source: www.axios.com

Here are the federal tax brackets for 2023, The tax tables below include the tax rates,. The il tax calculator calculates federal taxes (where applicable), medicare, pensions plans (fica.

Source: disneyrety.weebly.com

Source: disneyrety.weebly.com

Us tax brackets disneyrety, As is the case every year, new brackets, forms and. Here's how those break out by filing status:

Source: charmanewfay.pages.dev

Source: charmanewfay.pages.dev

Tax Brackets 2024 What I Need To Know. Jinny Lurline, 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate ). The illinois tax calculator is updated for the 2024/25 tax year.

The Extended Due Date For Filing Your Return Is October 15, 2024.

As is the case every year, new brackets, forms and.

The Illinois Income Tax Rate Is A Flat 4.95%.

New 2024 tax rates and thresholds.

Enter The Illinois Base Income You Expect To Receive In 2024.

The average tax refund is bigger so far this year.

Posted in 2024